| Capital | Hanoi |

| Area | 331,213 km² |

| Population | 96,460,000 (2019 est.) |

| GDP | USD 261.9 billion (2019) |

| GDP Growth Rate Projections | 3.8% in 2021, usually around 6% annually pre-pandemic |

| Inequality (Gini Coefficient) | 35.7 (medium) |

| Human Development Index (HDI) | 0.693 |

| World Bank Income Status | Lower middle-income status |

| Key export | Electronics, textiles products, machinery, footwear products, transportation products, wooden products, seafood products, steel, crude oil, pepper, rice and coffee, tourism |

Vietnam is one of the fastest growing economies in ASEAN and has established strong project development processes to meet an expansive list of needed infrastructure projects. Vietnam actively promotes an export-oriented development growth model, and industrial activity and connectivity is clustered regionally. Northern industrial clusters are tied to economic and commercial activity in China and Laos, while southern clusters are more closely tied to Cambodia and Laos and involve greater levels of Thai investment. The government has plans for major improvements in linear infrastructure to connect these clusters. Vietnam’s total spend on infrastructure is relatively high as a proportion of its GDP.

Vietnam’s Infrastructure Gap

A 2016 study by the Asian Development Bank indicates that Southeast Asia needs approximately $2.7 trillion invested in energy, transportation, telecommunications, and water infrastructure by 2030.1Asian Development Bank, Meeting Asia’s Infrastructure Needs, Asian Development Bank, 2017, pages xiv and 43. This is approximately 6% of the region’s annual GDP, with actual needs higher in less developed countries. Energy and transportation account for more than 86% of the total projected needs, rising to 88% if climate considerations are taken into account.2ADB, page 45.

The World Bank estimates that $10 billion annually – two thirds of the total annual expenditures on infrastructure in Vietnam – comes from the public sector.3Makhtar Dip, “Accelerating Vietnam’s path to prosperity,” World Bank, February 2019, https://blogs.worldbank.org/voices/accelerating-vietnams-path-prosperity. Vietnam’s annual national budget and private infrastructure investment spending are already among the highest in the Mekong region and account for approximately 5.8% of GDP.4ADB, page 29. While this high spending rate puts Vietnam on track to meet 83% of projected needs, there is still a $102 billion spending gap through 2040.5Infrastructure Outlook, “Vietnam”, Infrastructure Outlook, retrieved October 23, 2020, at https://outlook.gihub.org/countries/Vietnam Energy is by far the largest portion of this, followed by telecommunications and then transportation.

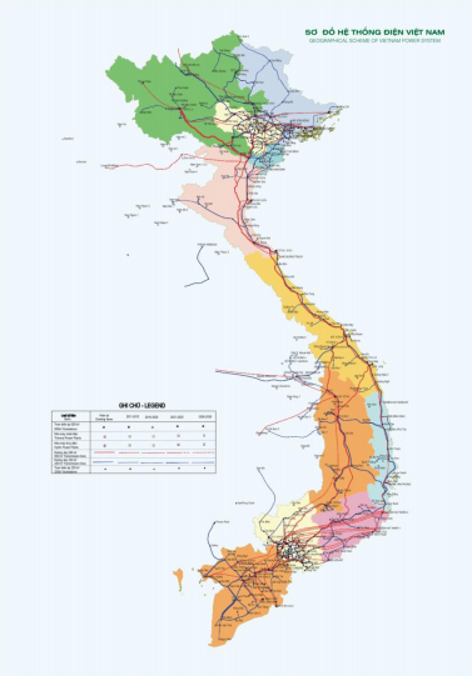

Energy Sector Overview

Power Generation

Vietnam’s electricity demand growth has averaged 10% over the last five years.6Tim Ha, “Vietnam considers scrapping half of coal power plant pipeline in favor of gas and renewables,” Eco-Business, July 28, 2020, accessed September 28, 2020 at https://www.eco-business.com/news/vietnam-considers-scrapping-half-of-coal-power-plant-pipeline-in-favour-of-gas-and-renewables/. Policymakers estimated an average electricity demand growth of 8% annually until 2035 in the most recent national power development plan.7Vietnam Business Forum, Made in Vietnam Energy Plan 2.0, December 1, 2019, page 32. That translates to approximately 95,000 MW of additional power generation to be installed through 2030, nearly quadrupling the total installed capacity since 2014.8Intelligent Energy Systems (ES), Alternatives for Power Generation in the Greater Mekong Subregion, Volume 6: Socialist Republic of Vietnam Power Sector Scenarios, May 2016, page 14, athttp://d2ouvy59p0dg6k.cloudfront.net/downloads/ies_mke_vietnam_power_sector_vision_part_2.pdf. Most of this demand rise is driven by industrialization and urbanization, as Vietnam has already achieved universal electrification. The draft of the upcoming Power Development Plan 8has gone through numerous iterations and revisions in response to market shifts, but as of September 2021 anticipates between 130,000 – 143,000 MW of installed capacity by 2030. This would include approximately 19% hydropower, 30% coal, 22% LNG, 25% renewable energy, and the remainder from imported electricity.9Huong Thuy, “Latest draft of national Power Development Plan VIII up for comments,” Vietnam Investment Review, September 7, 2021, at https://vir.com.vn/latest-draft-of-national-power-development-plan-viii-up-for-comments-87378.html.

Data from the Mekong Infrastructure Tracker indicates that, as of 2021, Vietnam’s installed generation capacity has reached 65,265 MW, with coal generation contributing 22,675 MW (34.7%), hydropower 18,169 MW (27.8%), natural gas 7,606 MW (11.6%), solar photovoltaic 14,415 MW (22%), wind 1092 MW (1.7%), oil 915 WM (1.4%), and biomass and waste contributing 367 MW (<1%). The authors know that this is in fact an undercount on solar projects. Rapidly rising demand, shifting market conditions, and delays in development of natural gas projects have spurred the government to seek investments in renewable energy infrastructure like wind and solar.10[iv] Vietnam Briefing, “Renewables in Vietnam: Current Opportunities and Future Outlook”, Vietnam Briefing, retrieved on 27 May 2020. https://www.vietnam-briefing.com/news/vietnams-push-for-renewable-energy.html/ The rapid proliferation of solar projects has made it difficult to track and verify location and other key details for inclusion in the Tracker in real-time.

Data from the Mekong Infrastructure tracker shows Vietnam will add an additional 6,479 MW of capacity in the short term through 2022, with a PDP8 draft target of more than 130,000 MW by 2030. This 2030 target continues to change as power development planning practices improve to incorporate more efficient forms of power generation and grid management. Currently eight new coal plants totaling 8,865 MW are under construction. There are 20 dams under construction, all but two are less than 100 MW. This is primarily because Vietnam has mostly exhausted its ability to exploit domestic hydropower resources without running afoul of water resource regulations.

In recent years favorable market conditions have created openings for significant investment in scale solar and wind plants. The Tracker includes 2,015 MW of solar projects and 534 MW of wind projects under construction, mostly focused in the southern coastal areas. Installed solar capacity rose from almost nothing in 2017 to more than 14,415 MW or approximately 22% of Vietnam’s entire installed capacity as of September 2021. Notably, approximately 9,500 MW of this is entirely rooftop solar which is spread across over 104,282 separate installations—the Tracker does not include site specific data on rooftop solar.11EVN Solar, Homepage, updated September 17, 2021, accessed at https://solar.evn.com.vn/#/.

There are approximately 11,456 MW of additional utility-scale solar projects under consideration. This rapid expansion has now caused grid congestion issues given limited transmission capacity and echoes challenges observed in countries which incorporate intermittent forms of renewable generation too quickly. Much of the rush toward renewable energy is in response to the Communist Party of Vietnam’s commitment to minimize future coal expansion, recognizing air pollution and climate change impacts could severely increase future governance challenges in the densely populated and increasingly urban country.

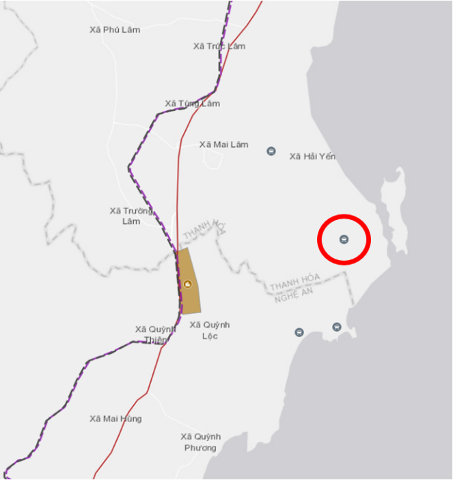

Prominent Project Snapshot: Nghi Son Thermal Power Plant

| Project Name | Nghi Son 2 Thermal Power Plant, Thanh Hoa |

| Subtype | Coal |

| Current Status | Under Construction |

| Capacity (MW) | 1200 |

| Year of Completion | 2022 |

| Country of Sponsor/Developer | Japan; South Korea |

| Sponsor/Developer Company | Marubeni Corporation (Japan) & Korea Electric Power Company (South Korea) (50-50% equity) |

| Country list of Lender/Financier | South Korea; Japan; Singapore; Malaysia |

| Lender/Financier | Export-Import Bank of Korea (Kexim); Japan Bank for International Cooperation (JBIC); DBS Bank (Singapore); Mizuho (Japan); MUFG (Japan); SMBC (Japan); Shinsei Bank (Japan); OCBC (Singapore); Maybank (Malaysia) |

| Country | Vietnam |

| Province/State | Thanh Hoa |

| District | Tinh Gia |

| Watershed | Vietnam Coastal Rivers Thanh Hoa-Nghe An |

| Latitude | 19.31628 |

| Longitude | 105.8009 |

The Nghi Son Power Plant is a 1,800 MW coal-fired power plant in Thanh Hoa Province which has two separate phases. The first 600 MW Nghi Son 1 power plant came online in Thanh Hoa Province in 2014 and was developed by Electricity Vietnam with construction through Marubeni. The second phase is a 1,200 MW super-critical coal plant which will be built just south of the Nghi Son 1 and which will be a 50:50 joint venture with support from Marubeni Corporation and the Korea Electric Power Corporation.12NS Energy, “Nghi Son 2 Thermal Power Plant, Thanh Hoa”, NS Energy, retrieved on 7 Apr. 2020. https://www.nsenergybusiness.com/projects/nghi-son-2-thermal-power-plant-thanh-hoa/ The Nghi Son 2 Power Plant will be built as an independent power project and has a contract to sell electricity to EVN for 25 years after coming online.13Marubeni Corporation, “Receipt of Notification of Award for Vietnam, Nghi Son 2 Coal-Fired Power Project,” March 13, 2013, accessed October 30, 2020, at https://www.marubeni.com/en/news/2013/release/00011.html.

The project has not been without controversy: some residents of Hai Ha and Ky Loi communes have been resettled in favor of the coal power plant and related industrial projects. Some have protested against the expansion over issues with resettlement and the replacement of the fishing port.14Le Quynh, “Vietnamse provinces say ‘no’ to coal plants—government and industry still want more,” Mekong Eye, March 7, 2019, accessed October 30, 2020, at https://www.mekongeye.com/2019/03/07/vietnamese-provinces-say-no-to-coal-plants-but-the-government-and-industry-build-more/. There have also been concerns raised about the fact that Nghi Son 2 is a major coal plant given the rising concern over air pollution and climate change emissions, with a key member of the original financing syndicate pulling out over climate concerns.15Robin Hicks, “1,200 megawatt Vietnam coal plant gets funding, but Standard Chartered pulls out over climate policy conflict,” Eco-Business, April 19, 2018, accessed October 30, 2020, at https://www.eco-business.com/news/1200-megawatt-vietnam-coal-plant-gets-funding-but-standard-chartered-pulls-out-over-climate-policy-conflict/. After some delays in construction, the project is expected to come online in 2022.16“Doosan Heavy Industries begins construction of thermal power plant in Vietnam,” Pulse News, July 26, 2018, accessed October 30, 2020, at https://pulsenews.co.kr/view.php?year=2018&no=469625.

Vietnam Solar Rooftop Projects

| Project Name | Vietnam Solar Rooftop Projects |

| Subtype | Solar |

| Current Status | Operational |

| Capacity (MW) | 9,205 MW |

| Year of Completion | 2020 |

| Country of Sponsor/Developer | N/A |

| Sponsor/Developer Company | N/A |

| Country list of Construction/EPC | N/A |

| Lender/Financier | N/A |

| Country | Vietnam |

The Vietnam Solar Rooftops Projects is a nationwide collection of over 101,100 rooftop solar systems found on residential, commercial, and industrial premises.17Nadhilah Shani and Beni Suryadi, “Vietnam Smashes 2020 Solar Capacity Records,” The ASEAN Post, April 10, 2021, accessed September 30, 2021, at https://theaseanpost.com/article/vietnam-smashes-2020-solar-capacity-records The combined capacity of these rooftop systems total a peak capacity of 9.3 GW, a massive increase over prior solar capacity in Vietnam. Within just one year of the Solar Rooftops Project, installed solar capacity increased 25-fold in Vietnam. This growth was made possible through the use of a solar feed-in-tariff program, which incentivized new solar projects. The feed-in-tariff granted 0.084 US cent per kilowatt hour over a 20-year period for rooftop solar projects. Feed-in-tariffs for floating and ground-mounted solar developments were lower (0.077 and 0.071USc per kWh, respectively) to encourage development of solar without additional land use or transmission lines.18Thu Vu, “IEEFA: Vietnam’s extraordinary rooftop solar success deals another blow to the remaining coal pipeline,” Institute for Energy Economics and Financial Analysis (IEEFA), January 12, 2021, accessed September 30, 2021, at https://ieefa.org/ieefa-vietnams-extraordinary-rooftop-solar-success-deals-another-blow-to-the-remaining-coal-pipeline/. In fact, the immense success of the Solar Rooftop Projects might be primarily due to the feed-in-tariff system while other ASEAN countries, such as Thailand and Malaysia, have been less successful in their implementation of solar net-metering.19Nadhilah Shani and Beni Suryadi, “Vietnam Smashes 2020 Solar Capacity Records,” The ASEAN Post, April 10, 2021, accessed September 30, 2021, at https://theaseanpost.com/article/vietnam-smashes-2020-solar-capacity-records

Additionally, the Solar Rooftops Project fits a larger trend of rapid solar development in Vietnam. From 2017-2019, Vietnam’s utility-scale solar capacity increased by 4.5 GW. As of 2021, national solar capacity is at least 16.6 GW, roughly a quarter of the national energy mix.20Thu Vu, “IEEFA: Vietnam’s extraordinary rooftop solar success deals another blow to the remaining coal pipeline,” Institute for Energy Economics and Financial Analysis (IEEFA), January 12, 2021, accessed September 30, 2021, at https://ieefa.org/ieefa-vietnams-extraordinary-rooftop-solar-success-deals-another-blow-to-the-remaining-coal-pipeline/. 21Slade Johnson, Kien Chau and Lindsay Aramayo, “Vietnam’s latest power development plan focuses on expanding renewable sources,” U.S. Energy Information Administration, June 1, 2021, accessed September 30, 2021, at https://www.eia.gov/todayinenergy/detail.php?id=48176. Under PDP8, Vietnam hopes to increase solar capacity to 18.6 GW by 2030. This goal departs significantly from previous PDPs, which emphasized the growth of hydropower, natural gas, and coal. The remaining challenge, though, is to prioritize transmission and distribution infrastructure so that Vietnam’s national grid can handle its newfound solar capacity.22Slade Johnson, Kien Chau and Lindsay Aramayo, “Vietnam’s latest power development plan focuses on expanding renewable sources,” U.S. Energy Information Administration, June 1, 2021, accessed September 30, 2021, at https://www.eia.gov/todayinenergy/detail.php?id=48176.

Electricity Transmission

Vietnam’s electricity market is centralized under the state-owned utility Electricity Vietnam: although independent power producers have a role in power generation, EVN has a monopoly over transmission and distribution.23Vinh Quoc Nguyen and Tu Ngoc Trinh, “Electricity regulation in Vietnam: overview,” Tilleke & Gibbons, October 1, 2020, accessed November 2, 2020, at https://uk.practicallaw.thomsonreuters.com/4-628-5349. Vietnam independently developed grids in the north, central, and southern regions in previous decades but all three are connected by 500 kilovolt backbone transmission lines. Although Vietnam does have a national grid, these backbone lines are close to capacity in many areas and construction of new and upgraded lines has been slow.24Vinh Quoc Nguyen and Tu Ngoc Trinh. This has caused difficulties in accommodating new power generation like solar power that is rapidly built out to meet rising demand. In mid-2020 the Ministry of Energy and Trade proposed allowing for private companies to build out transmission lines and substations that connect to the national grid to help manage the strain.25Anh Minh and Dat Nguyen, “Ministry calls for allowing private investment in power transmission,” VN Express, May 5, 2020, accessed November 2 2020, at https://e.vnexpress.net/news/business/economy/ministry-calls-for-allowing-private-investment-in-power-transmission-4094268.html.

Vietnam currently has cross-border power trade with its three neighbors: China, Laos, and Cambodia. Historically, Vietnam has exported electricity to Cambodia, imported electricity from China, and planned to import electricity from Laos. All of these lines are currently 220kv lines or smaller, partly because the historical amounts of electricity trade has been quite limited due to concerns over energy security. Vietnam’s trade with China has previously peaked around 1.5 Terawatt-hours (TWh) of electricity, and sales to Cambodia have historically hit 1 TWh annually.26Thi Thu Nga Vu, Gilbert Teyssiere, Severine LE Roy, Tung Tran Anh, Thanh Son Tran, Xuan Truong Nugyen, and Quang Vinh Nguyen, “The Challenges and Opportunities for Power Transmission Grid of Vietnam,” European Journal of Electrical Engineering, Vol. 21, no. 6, December 2019, page 493. Accessible at https://www.researchgate.net/publication/338170207_The_Challenges_and_Opportunities_for_the_Power_Transmission_Grid_of_Vietnam. These will likely need to be upgraded in the future given plans to raise electricity imports to 5,000 MW in coming decades.27Xinhua, “Vietnam set to import more electricity from China, Laos,” Xinhua, May 29, 2019, accessed November 2, 2020, at http://www.xinhuanet.com/english/2019-05/29/c_138100358.htm.

Linear Connectivity

The Logistics Performance Index—which ranks countries based on perceptions of efficiency with border clearance and customs, quality of transport infrastructure, and a range of considerations related to shipping—ranks Vietnam 39 out of 160 countries.28World Bank, “Logistics Performance Index Global Rankings 2018,” https://lpi.worldbank.org/international/global. Vietnam’s total investment in infrastructure is higher than many of its neighbors and there have been major improvements in recent years to physical connectivity.

Vietnam’s Transport Development Strategy, most recently updated in March 2009, projected more than 6 billion passenger movements annually by 2020. The vast majority of transportation in Vietnam is by road (86-90%), although inland waterways (4.5-7.5%) play a role in the Mekong Delta and some passengers (1-2%) use railway and a smaller percentage use airplanes.29Oxford Business Group (OBG), “Vietnam’s focus on transport infrastructure aims to enhance efficiency of moving goods and travellers”, OBG, retrieved on 27 May 2020. https://oxfordbusinessgroup.com/overview/easy-flow-focus-transportation-infrastructure-aims-enhance-efficiency-moving-goods-and-travellers Cargo volumes depend primarily on road (65-70%), although waterways play a significant role in cargo (17-20% by inland waterways, and an additional 9-14% by sea), with the remainder by railway and air.30Oxford Business Group. One transportation sector challenge moving forward involves coordination: many of the projects are identified at a provincial level rather than a national level, which for transportation has resulted in disconnect between supply and demand and has in some cases led to provincial competition.31World Bank Group, Vibrant Vietnam, page 38.

The Mekong Infrastructure Tracker dataset shows project-level data for Vietnam of 33,458 km of roadways, 2006 national road upgrades, 3193 km of railway, and 1,897 km of high-speed railway. The Tracker’s canal also includes 6,268 km of canals, although this data is limited to the Mekong Delta, Saigon River Delta, and the Red River Delta.

Road Transport

Currently, only 20 per cent of Vietnam’s national roads are paved.32Infrastructure Vietnam, “Infrastructure Vietnam 2019 (IVN2019)”, Infrastructure Vietnam, retrieved on 27 May 2020. http://infrastructurevietnam.com/ The Tracker includes 29,302 km of operational projects designated as national roads, which tend to be paved and of higher quality. The remainder of Vietnam’s 236,000 km of road network consists of district and rural roads which are of lower quality, including many unpaved roads.33Oxford Business Group. As the vast majority of transportation is by road, the government plans to expand national highways significantly in coming years to improve regional connectivity and better support trade flows. While Vietnam is in relatively good shape in terms of total financing compared to many of its neighbors, only ten percent of capital investments have been used to support maintenance of the road network. This is notably lower than most OECD countries and some of Vietnam’s ASEAN neighbors.34World Bank Group, Vibrant Vietnam: Forging the Foundation of a High-Income Economy, May 2020, page xvii, http://documents1.worldbank.org/curated/en/745271590429811414/pdf/Main-Report.pdf. Consideration of these maintenance and life-cycle costs is important to ensure improvements to the future transportation network.

Rail Transport

Rail plays a relatively minor role nationally for transportation and only attracts 3% of annual transportation investment, but it still supports annual rides of around 11 million as of 2015.35Oxford Business Group. While rail ridership has been slowly dropping, the government approved plans in 2002 to upgrade and modernize the network so that it can support high-speed trains.36Oxford Business Group. The master plan envisions increasing rail transportation’s market share to handle 25% of freight movements and 20% of passenger movements by 2020, in addition to investing USD 7 billion in new railways over the same time period.37Oxford Business Group. Some of the future investments are likely to be international: in late 2019, officials announced plans to upgrade the transnational rail lines between Hanoi through to Kunming.38Wu Shang-su, “Belt and rail: New Vietnam – China train aims to put relations on track,” The Interpreter, January 15, 2020, accessed October 30, 2020, at https://www.lowyinstitute.org/the-interpreter/belt-and-rail-new-vietnam-china-train-aims-put-relations-track.

The Mekong Infrastructure Tracker includes project-level data on 2,909 km of operational rail and 299 km of completed railway upgrades. However, Vietnam has significant plans to expand this: one planned rail project would add 1,897 km of high-speed rail between Hanoi and Ho Chi Minh City and an additional 236 km of traditional railways are in the works.

Urban Connectivity

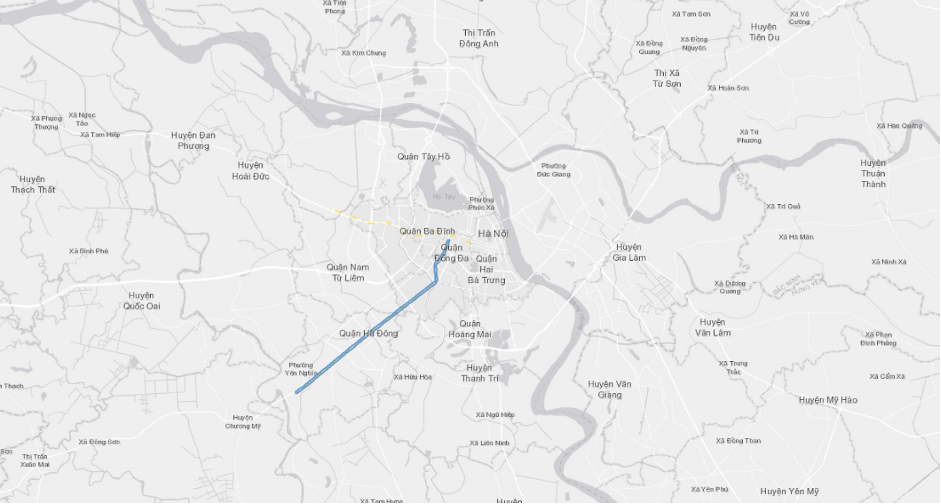

Vietnam has rapidly urbanized with migrant workers flocking to cities, and projections indicate that by 2030 approximately 50% of Vietnam’s population will live in cities.39“Vietnam’s urbanization rate in 2019 to reach 40%,” Vietnam Net, February 23, 2019, accessed October 30, 2020, at https://english.vietnamnet.vn/fms/society/218251/vietnam-s-urbanization-rate-in-2019-to-reach-40-.html. http://infrastructurevietnam.com/. Much of this will be concentrated in Hanoi (6.4 million people) and Ho Chi Minh City (nearly 11.1 million people).40Urbanet, “Urbanization in Viet Nam: Infographics,” May 2, 2019, accessed October 30, 2020, at https://www.urbanet.info/vietnam-urban-development-infographics/. Both Hanoi and Ho Chi Minh City are building urban transit systems which will hopefully help reduce traffic and improve air quality. The two projects are often contrasted: while both projects have faced significant delays, Ho Chi Minh City has contracted a Japanese company which has had no major safety issues and is relatively accessible, but the Hanoi metro is contracted to a Chinese company that has faced reputational challenges after a series of accidents, safety concerns, and critiques of inaccessibility to users.41Michael Tatarski, “Vietnam’s tale of two metros, one built b y the Japanese and the other by the Chinese,” South China Morning Post, July 30, 2017, accessed October 30, 2020, at https://www.scmp.com/week-asia/business/article/2104149/vietnams-tale-two-metros-one-built-japanese-and-other-chinese.

Project Snapshot: Cat Lin-Ha Dong Metro Line

| Project Name | Cat Linh – Ha Dong Metro (Metro Line 2A) |

| Subtype | Urban Rail |

| Current Status | Under Construction |

| Length (km) | 15.554 km |

| Sponsor/Developer Country | Vietnam |

| Sponsor/Developer Company | Ministry of Transportation |

| Construction/EPC Country | China |

| Construction/EPC Company | China Railway Sixth Group Co Ltd (China) |

| Financier Country | China |

| Financier Company | China Export-Import Bank |

| Country | Vietnam |

| State or Province | Hanoi |

| Main Basin | Red – Yuan River |

| Tributary Basin | Red River Mainstream and Delta |

Metro Line 2A in Hanoi came online in early 2021 and is the first operational urban rail in Vietnam. The project has been over a decade in the making: construction began in 2011, and the project was originally planned for completion in 2013.42Doan Loan, “Hanoi’s first metro to operate commercially by year-end,” Vietnam Express, July 11, 2020, accessed at https://e.vnexpress.net/news/business/economy/hanoi-s-first-metro-to-operate-commercially-by-year-end-4128968.html. However, loan disbursement issues, safety reviews, contract disagreements, and other delays led to years of halted progress and delays.43Tomoya Onishi, “Vietnam’s China-built metro line falls 2 years behind schedule,” Nikkei Asian Review, July 20, 2020, at https://asia.nikkei.com/Business/Transportation/Vietnam-s-China-built-metro-line-falls-2-years-behind-schedule. The costs have surpassed $868 million as of late 2019, nearly 60% higher than the original estimates of $553 million.44Dat Nguyen, “Construction work done, Hanoi metro gets ready to run,” VN Express, December 20, 2019, at https://e.vnexpress.net/news/business/economy/construction-work-done-hanoi-metro-gets-ready-to-run-4030193.html. Construction on the rail line was completed in mid-2018, but final station construction and safety checks took two more years to finalize. Safety paperwork was submitted in July 2020, and the project received safety clearance in April 2021.45Doan Loan, “Hanoi’s first metro to operate commercially by year-end,” VN Express, July 11, 2020, at https://e.vnexpress.net/news/business/economy/hanoi-s-first-metro-to-operate-commercially-by-year-end-4128968.html.

Industrial Zones and Special Economic Zones

Vietnam leads the Mekong region in the number and total area of industrial zones, with more than 731 square kilometers composing 257 industrial zones oriented mostly for manufacturing of export products. Vietnam’s industrial capacity is focused in the north around Hanoi and in the south near Ho Chi Minh City and the Mekong Delta with most zones opening for business in the decade between 2004 and 2014. The central coastal provinces have also followed suit with the promotion of industrial zones for export processing, but these areas lack the connectivity and clustering benefits that come with industrial activity in the north and south.

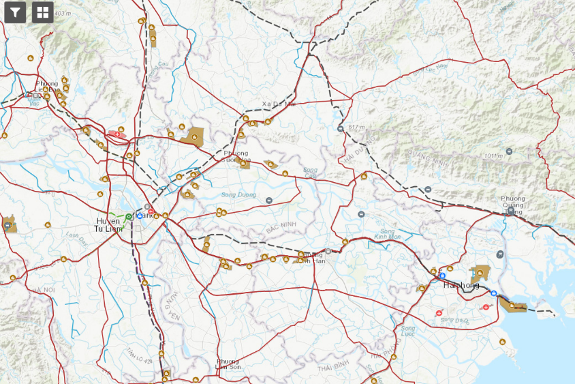

Red River Delta

The Red River watershed and floodplain has 85 industrial zones totaling 195 square kilometers in area. The image above shows industrial activity and connectivity in the Hanoi-Haiphong corridor at the heart of Red River watershed development. Four airports, two major seaports, and a robust rail and road network facilitate industrial development along this corridor. Prominent owners of industrial zone leases are from Vietnam, Taiwan, Japan, Singapore, South Korea, and China.

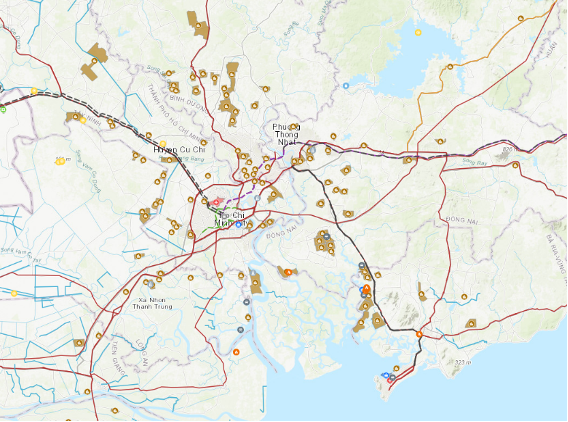

Ho Chi Minh City

The Saigon coastal area has 111 industrial zones totaling 259 square kilometers in area. The image above shows industrial activity and connectivity between Ho Chi Minh City and Ba Ria-Vung Tau to the southeast. Highway connectivity is rapidly linking this corridor together and providing access to two deep water ports southeast of HCMC. Prominent owners of industrial zone leases are from Vietnam, Taiwan, Japan, Singapore, and China.

Airports and Air Travel

Air transportation holds a very limited role in Vietnam’s overall cargo and passenger transit system, but this share is rapidly growing. As of 2019 air passenger volumes reached 116 million, up from 63 million in 2015.46Oxford Business Group; International Trade Administration, “Vietnam Aviation,” U.S. Department of Commerce, August 11, 2020, accessed November 2, 2020, at https://www.trade.gov/market-intelligence/vietnam-2020-aviation-update. The country has experienced double-digit annual growth for both passengers and cargo.47International Trade Administration, “Vietnam Aviation.” By 2030 passenger volume is expected to reach 322 million annually.48Oxford Business Group. The growth outpaced infrastructure availability and plans: as of 2018, Tan Son Nhat International Airport in Ho Chi Minh City handled 36 million passengers annually, which is 44% higher than the designed passenger capacity.49Huu Cong, “Vietnam airport expansion requires vicinity upgrade in tandem: Minister,” VN Express, August 5, 2018, accessed November 2, 2020, at https://e.vnexpress.net/news/business/vietnam-airport-expansion-requires-vicinity-upgrade-in-tandem-minister-3787688.html.

Vietnam’s domestic market is dominated by low-cost carriers like VietJet Air and the Ministry of Transportation signed on to the ASEAN Single Aviation Market (or ASEAN Open Skies protocol) in 2016 in part to support these domestic airlines in launching more international routes.50Oxford Business Group.

As a result of rising pressures on limited airports, aviation infrastructure expansion was a major focus under the Ministry of Transport’s most recent plans, including $4.9 billion to build a second major international airport near Ho Chi Minh City.51Thi Ha, “Vietnam may start building its biggest airport in 2020,” VN Express, November 20, 2018, accessed November 2, 2020, at https://e.vnexpress.net/news/business/economy/vietnam-may-start-building-its-biggest-airport-in-2020-3841868.html. The Mekong Infrastructure Tracker has data on 25 existing airports in Vietnam.

Sea Ports and Terminal Growth

Vietnam is a coastal country, with approximately 3,200 km of coast and 320 ports, approximately 45 of which are seaports with extensive container capacity.52Viet Nam News, “Vietnamese port infrastructure needs to keep pace with growth,” October 21, 2019, accessed November 2, 2020, at https://vietnamnews.vn/economy/537172/vietnamese-port-infrastructure-needs-to-keep-pace-with-growth.html. Many of the world’s busiest maritime trade routes cross through the South China Sea, and Vietnam’s port infrastructure is anticipated to expand significantly in coming years as Vietnam’s role in regional supply chains expands. Vietnam has logged container traffic growth of 10-12% annually, far faster than the international average.53Anh Hong, “Vietnamese port infrastructure urged to keep pace with growth,” Hanoi Times, October 25, 2019, accessed November 2, 2020, at http://hanoitimes.vn/vietnamese-port-infrastructure-urged-to-keep-pace-with-growth-46860.html. Marine trade through seaports rose from 427 million tons in 2015 to 664 million tons in 2019.54General Statistics Office of Vietnam, August 3, 2020, accessed at https://www.gso.gov.vn/en/px-web/?pxid=E0921&theme=Transport%2C%20Postal%20Services%20and%20Telecommunications.

Until 2011, Vietnam’s seaports were all relatively shallow with significant limitations on vessel size and resulting inefficiencies. As a result, most of the cargo was shipped first to large ports in neighboring countries like Singapore, Hong Kong, or Malaysia before being transshipped to markets elsewhere globally.55Oxford Business Group. However, as of 2019 most of the country’s major ports have been upgraded and can accommodate large tonnage.56Viet Nam News, “Vietnamese port infrastructure needs to keep pace with growth.” More than half of Vietnam’s total container cargo arrives through ports near Saigon, which in 2017 processed 62%; the remainder was primarily processed through the northern ports near Hai Phuong (33%).57Nguyen Xuan Tinh, “Port and Logistics Infrastructure in Vietnam, Opportunities for Cooperative Development,” Presentation at Busan International Port Conference, October 2018, accessed at http://bipc.kr/2018/pt/session_5/Nguyen_Xuan_Tinh.pdf.

Project Snapshot: Chu Lai Economic Zone

| Project Name | Chu Lai Economic Zone |

| Subtype | Special Economic Zone |

| Current Status | Operational |

| Project Development Cycle Stage | Project completion |

| Year of completion | 2008 |

| Area (km2) | 1019.694 |

| Sponsor/Developer | Quang Nam Industrial park Infrastructure development Company |

| Country list for Sponsor/Developer | Vietnam |

| Country | Vietnam |

| State or Province | Da Nang; Quang Nam; Quang Ngai |

| District | Hoa Vang; Ngu Hanh Son; Dien Ban; Duy Xuyen; Hoi An; Nui Thanh; Phu Ninh; Que Sơn; Tam Ky; Thang Binh; Binh Son |

| Main Basin | Vietnam Coastal Rivers Quang Binh-Quang Tri-Hue |

| Tributary | Hue-Danang coastal rivers |

| Latitude | 15.69940796 |

| Longitude | 108.4175781 |

| Data Source | Vietnam Industrial Parks Investment Promotion |

| Source Link | https://viipip.com/ipen/?ipcode=173 |

| Announcements/More Information | https://thacogroup.vn/en/communications/News/06960F/announcing-the-master-plan-revisions-of-chu-lai-open-economic-zone-and-the-15th-anniversary-of-thaco---chu-lai.aspx |

| Latest update | 09/08/2020 |

Quang Nam province has become an important and strategic destination for infrastructure investment in central Vietnam given its importance in facilitating regional trade and proximity to Da Nang, tourist hubs in Hoi An and Hue, and Laos.58Ha Nguyen, “Investing in Vietnam’s Quang Nam Province – 3 Competitive Factors”, Vietnam Briefing, 2019, retrieved on 28 October 2020 at https://www.vietnam-briefing.com/news/investing-vietnams-quang-nam-province-3-competitive-factors.html/ The Chu Lai Open Economic Zone (OEZ) was Vietnam’s first coastal Special Economic Zone, constructed in 2003.59Chu Lai Open Economic Zone, “Open Letter”, Chu Lai Open Economic Zone, 2019, retrieved on 28 October 2020 at http://chulai.quangnam.gov.vn/?menu=xemchitiettin&idchuyenmuc=24&idtintuc=15&lang=ene It spans a total area of over 160 square miles. The Zone includes 158 projects worth a total investment value of approximately USD $3.7 billion, with 33 foreign direct investment (FDI) projects worth USD $666 million.60“Chu Lai Open Economic Zone Actively Capturing New Opportunities,” Vietnam Business Forum, July 24, 2019, accessed October 30, 2020, at https://www.vccinews.com/news/37100/chu-lai-open-economic-zone-actively-capturing-new-opportunities.html.

Robust infrastructure has been key to the success of Chu Lai OEZ. Chu Lai International Airport is located within the OEZ, conveniently close to the provincial capital of Tam Ky. In 2018 the provincial authorities announced revisions to the master plan to adapt to the significant growth experienced over the zone’s first 15 years of operation. These include plans for a massive upgrade for Ky Ha deep-water port that will allow larger container vessels to dock and expand tourism harbors and wharfs, slated to be completed by 2030.61Nhan Tam, “Quang Nam to develop Chu Lai Port into port hub,” The Saigon Times, October 31, 2018, accessed October 30, 2020, at https://english.thesaigontimes.vn/63818/quang-nam-to-develop-chu-lai-port-into-port-hub.html.