| Capital | Vientiane |

| Area | 237,950 km² |

| Population | 7,169,000 (2019 est) |

| GDP | USD 18.17 billion (2019) |

| GDP Growth Rate Projections | 2.3% in 2021, usually around 6.8% annually |

| Inequality (Gini Coefficient) | 41.1 (medium) |

| Human Development Index (HDI) | 0.64 |

| World Bank Income Status | Lower middle-income |

| Key export | Hydropower, tourism, wood, clothing, coffee, rubber, metals |

Upgrading infrastructure is a key part of Lao PDR’s strategy to graduate from Least Developed Country status, a milestone which policymakers originally hoped to achieve by 2020 but have more recently pushed back to the mid-2020s.1Open Development Laos, “Infrastructure”, Open Development Mekong, retrieved on 3 August 2020. https://laos.opendevelopmentmekong.net/topics/infrastructure#ref-444-11; Souksakhone Vaenkao, “Laos reaffirms commitment to LDC graduation despite challenges,” The Vientiane Times, September 10, 2020, http://www.vientianetimes.org.la/freeContent/FreeConten_Laos176.php. Lao PDR’s national plans to become the Battery of Southeast Asia by exporting electricity have led to the buildout of dozens of large-scale hydroelectric dams, including 9 planned for the mainstream of the transboundary Mekong River. There are more than 280 additional dams in early phases of development, although 152 of these are small-scale dams under 15 MW. As the only country bordering all the other Mekong countries, Lao PDR has a strategy to transform from a land-locked to a land-linked nation with other stronger economies.2Department of Planning and Cooperation, Ministry of Public Works and Transport, Lao PDR, “Laos Trade Facilitation: Current on Cross Border Transport Connectivity Infrastructure”, United Nations Economic and Social Commission for Asia and the Pacific (UNESCAP), retrieved on 3 August 2020. https://www.unescap.org/sites/default/files/Session%205_Lao%20PDR.pdf Infrastructure stock has been growing rapidly in Lao PDR, while gaps in coverage remain and the quality of infrastructure still needs to be improved.3World Bank Group, “Lao People’s Democratic Republic: Systemic Country Diagnostic, Priorities for Ending Poverty and Boosting Shared Prosperity”, World Bank Group, retrieved 29 July 2020. http://documents1.worldbank.org/curated/en/983001490107755004/pdf/Lao-PDR-SCD-03-09-2017-03162017.pdf

Lao PDR’s Infrastructure Gap

A 2016 study by the Asian Development Bank indicates that Southeast Asia needs approximately $2.7 trillion invested in energy, transportation, telecommunications, and water infrastructure by 2030.4Asian Development Bank, Meeting Asia’s Infrastructure Needs, Asian Development Bank, 2017, pages xiv and 43. This calculates to approximately 6% of the region’s annual GDP, with actual needs higher in less developed countries. The needs in Lao PDR are significantly higher than the regional average: infrastructure financing demands are estimated at 13.6% of national GDP (US$11 billion) through 2020 and 10.2% of GDP through 2030.5Biswa Nath Bhattacharyay, “Estimating Demand for Infrastructure in Energy, Transport, Telecommunications, Water and Sanitation in Asia and the Pacific: 2010-2020”, Asian Development Bank Institute, retrieved 28 July 2020. https://www.adb.org/sites/default/files/publication/156103/adbi-wp248.pdf; Candice Branchoux, Lin Fang, and Yusuke Tateno, “Estimating Infrastructure Financing Needs in the Asia-Pacific Least Developed Countries, Landlocked Developing Countries, and Small Island Developing States”, MDPI, retrieved 28 July 2020. https://www.mdpi.com/2227-7099/6/3/43.

With limited domestic financing available, infrastructure development in Lao PDR has greatly relied on the assistance of bilateral and multilateral donors and foreign direct investment.6OECD, “Chapter 7: Infrastructure connectivity in Lao PDR”, OECD iLibrary, retrieved 28 July 2020. https://www.oecd-ilibrary.org/finance-and-investment/oecd-investment-policy-reviews-lao-pdr/infrastructure-connectivity-in-lao-pdr_9789264276055-12-en;jsessionid=JdRyRLYTbdTyWbJ-LcF1c_uS.ip-10-240-5-77 Mining and hydropower are key drivers of economic growth and accounted for 80 percent of Foreign Direct Investment (FDI) in Lao PDR in 2018.7United States Department of State, “2018 Investment Climate Statements: Laos”, United States Department of State, retrieved 29 July 2020. https://www.state.gov/reports/2018-investment-climate-statements/laos/ Key players in the hydropower sector include China, Thailand, and Vietnam.8World Bank Group, “Lao People’s Democratic Republic: Systemic Country Diagnostic, Priorities for Ending Poverty and Boosting Shared Prosperity.” Much of this is undertaken by private companies, but Lao PDR has historically depended on Official Development Assistance (ODA) such as grants and low interest loans, which in 2018 accounted for more than 10 percent of total investment.9Laotian Times, “PM: Laos Won’t Graduate From Least Developed Country Status by 2020”, Laotian Times, retrieved 4 August 2020. https://laotiantimes.com/2018/06/11/laos-not-graduate-least-developed-country/

China, Japan, and South Korea are among the largest bilateral donors and creditors to Lao PDR.10Xinhua, “China-Laos trade, economic cooperation continuously develop in past 20 years”, Xinhua Net, retrieved 29 July 2020. http://www.xinhuanet.com//english/2017-07/06/c_136423290.htm11OECD – DAC, “Top Ten Donors of Gross ODA for Lao People’s Democratic Republic, 2017-2018 average, USD million”, Tableau Public, retrieved 29 July 2020. https://public.tableau.com/views/OECDDACAidataglancebyrecipient_new/Recipients?:embed=y&:display_count=yes&:showTabs=y&:toolbar=no?&:showVizHome=no China has become the biggest foreign donor and investor of Lao PDR, with Chinese railway and road investment aligning with Lao PDR’s national strategy of turning from a “land-locked” to a “land-linked” country.12Xinhua, “China-Laos trade, economic cooperation continuously develop in past 20 years.” Major multilateral institutions undertaking infrastructure activities in Lao PDR include the World Bank, International Finance Corporation (IFC), Asian Development Bank (ADB), Asian Infrastructure Investment Bank (AIIB), and Japan International Cooperation Agency (JICA).13 Infrastructure and Cities for Economic Development (ICED), “Infrastructure scoping study summary: Laos”, ICED, retrieved 29 July 2020. http://icedfacility.org/wp-content/uploads/2019/07/Laos_InfraSummary.pdf

Lao PDR has relatively high debt burden, The International Monetary Fund and other outside analysts have for years predicted that Lao PDR was vulnerable to debt distress due to high debt-to-GDP ratio, limited buffers in the event of shocks, and significant foreign-currency denominated loans.14International Monetary Fund, “Lao People’s Democratic Republic: Staff Report for the 2016 Article IV Consultation – Debt Sustainability Analysis,” January 6, 2017, at https://www.imf.org/external/pubs/ft/dsa/pdf/2017/dsacr1753.pdf. Due to the coronavirus pandemic’s impacts on the economy and drops in growth and income, Lao PDR’s debt levels have risen from 59% of GDP in 2019 and are projected to hit 68% in 2020.15World Bank, “COVID-19 to impact Lao PDR Growth, Debt in 2020: New World Bank Report,” May 20, 2020, accessed at https://www.worldbank.org/en/news/press-release/2020/05/20/covid-19-to-impact-lao-pdr-growth-debt-in-2020-new-world-bank-report. International credit agency Moody’s downgraded Lao PDR’s credit ratings in mid-2020 and “changed the outlook to negative” given the rising debt and liquidity stress.16Moody’s Investor Services, “Rating action: Moody’s downgrades Laos’s rating to Caa2, outlook changed to negative,” August 14, 2020, at https://www.moodys.com/research/Moodys-downgrades-Laoss-rating-to-Caa2-outlook-changed-to-negative–PR_429248.

Energy Sector Overview

Current Status of Power Generation

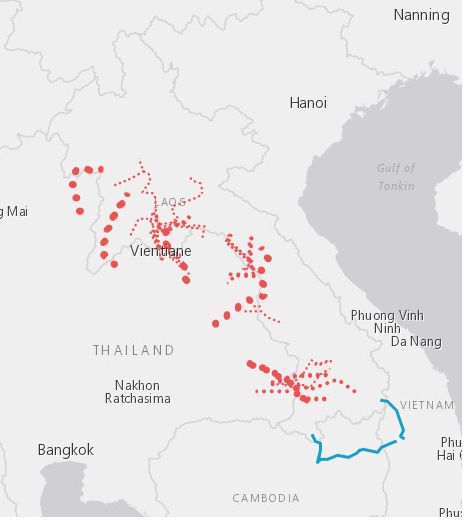

Lao PDR has capitalized on its estimated 26,000 MW of technical hydropower potential and aims to become the Battery of Southeast Asia by exporting electricity to neighboring markets. A massive investment program increased the installed capacity in the system from only 640 MW in 2000 to around 9,480 by 2020. The Mekong Infrastructure Tracker shows that most power generation is supplied from 63 hydropower dams totaling 7,559 MW in generation capacity. The remaining power is produced by the Hongsa coal plant (1,878 MW), a few biomass plants (35 MW), and 8 solar projects (42 MW).

As of 2020, 50 dams were under construction. Twenty-one of these are anticipated to come online by the end of 2020, boosting installed capacity to above 10,700 MW. The Lao PDR Ministry of Energy and Mines dam database lists more than three hundred more dams in the design/negotiation/feasibility study stage. Many of these dams – complete, under construction, or in planning stages—are controversial. Lao PDR is also exploring other renewable energy projects (solar, wind); but there is only limited analysis of the potential.17World Bank Group, “Lao People’s Democratic Republic: Systemic Country Diagnostic, Priorities for Ending Poverty and Boosting Shared Prosperity.” In early 2020, a Chinese firm has signed an MOU to build a 1200 MW floating solar plant on the Nam Ngum 1 reservoir, which will be the world’s largest floating solar plant when complete.18Jasmina Yap, “Laos to build world’s largest floating solar power project at Nam Ngum 1,” The Laotian Times, February 20, 2020, https://laotiantimes.com/2020/02/20/laos-to-build-worlds-largest-floating-solar-power-project-at-nam-ngum-1/. The Thai renewable energy company Impact Energy Asia is currently negotiating with the Government of Lao PDR to build a 600 megawatt wind-farm in southern Lao PDR, with construction forecast to be complete in 2023.19The Nation, “Laos promotes Thai-built wind farm on ASEAN stage,” April 27, 2016, accessed at https://www.nationthailand.com/Economy/30284861.

Although approximately 70% of Lao PDR’s generation capacity has been dedicated for export, domestic demand has been growing rapidly. Lao PDR’s per capita electricity consumption is among the lowest in ASEAN but is rising rapidly at an average rate of 14.5% annually over the past 10 years.20Asian Development Bank (ADB), “Lao People’s Democratic Republic: Energy Sector Assessment, Strategy, and Road Map”, ADB, retrieved on 30 July 2020. https://www.adb.org/sites/default/files/institutional-document/547396/lao-pdr-energy-assessment-2019.pdf Over 92% of households nationally had electricity access by the end of 2016, years ahead of the target set for 2020.21Asian Development Bank (ADB), Lao People’s Democratic Republic: Energy Sector Assessment, Strategy, and Road Map.” Lao PDR does not have a national power development plan which lays out prescribed demand and capacity targets over a specific planning period, but the national Energy Policy 2015 did establish broad goals for the power sector including provision of affordable, reliable, and sustainable electricity; improving and expanding transmission networks to facilitate power exchange; and expansion of the role for renewable energy to 30% of the power mix using a reasonable feed-in tariff scheme.22Asian Development Bank (ADB), Lao PDR: Accelerating Structural Transformation for Inclusive Growth, ADB, retrieved on 30 July 2020. https://www.adb.org/sites/default/files/publication/378726/lao-pdr-accelerating-structural-transformation.pdf

There are a diverse set of stakeholders involved in the power sector in Lao PDR. This is reflected in the Mekong Infrastructure Tracker. Across all project statuses (operational, under construction, planned), Thailand is the largest investor in Lao PDR’s power generation sector with full or partial ownership in 12,984 MW of generation capacity (hydropower 10,567 MW, coal 1817 MW, wind 600 MW). China ranks second highest with full or partial ownership in 8,063 MW of generation capacity (hydropower 6863 MW, solar 1200 MW). Vietnam ranks third highest with full or partial ownership of 2380 MW of hydropower generation. Companies registered in nine other countries including the United States, Republic of Korea, Japan, France, and several European countries also have full or partial ownership in each more than 100 MW of power generation projects.

Further development of the energy sector in an affordable, inclusive, and sustainable way has been prioritized in Lao PDR’s 8th Five-Year National Socio-Economic Development Plan [NSEDP] (2016-2020).23Ministry of Planning and Investment, “8th Five-Year National Socio-Economic Development Plan (2016-2020)”, United Nations Lao PDR, retrieved on 30 July 2020. https://laopdr.un.org/sites/default/files/2019-08/2016_8th%20NSEDP_2016-2020_English.pdf. According to the Initial Concept on the 9th NSEDP (2021-2025), the key objective is to fully focus on existing potentials for socio-economic development in order to graduate from Least Developed Country status and achieve the Sustainable Development Goals by 2030. One major outcome of the NSEDP is development and growth in accordance with the National Green Growth Strategy, which was released in 2019.24Phonevanh Outhavong, Director General of the Planning Department Ministry of Planning and Investment, November 2019, https://rtm.org.la/wp-content/uploads/2019/11/2019-RTIM-Pre-Consultation-on-NSEDP-and-State-Budget-Plan_Initial-Concept-of-the-9th-NSEDP_English.pdf. Lao PDR has seen rapid economic growth over the past several years, but the economy is heavily reliant on the exploitation of natural resources, which Deputy Prime Minister and Minister of Finance, Mr Somdy Duangdy has recognized will one day be depleted. The government is working to improve the business climate so that the economic base can be diversified.25Ekaphone Phouthonesy “Lao PDR commits to green growth path” Vientiane Times, March 6, 2019 http://vientianetimes.org.la/freeContent/FreeConten_Laos_commits_55.php.

Overview of Electricity Transmission Network

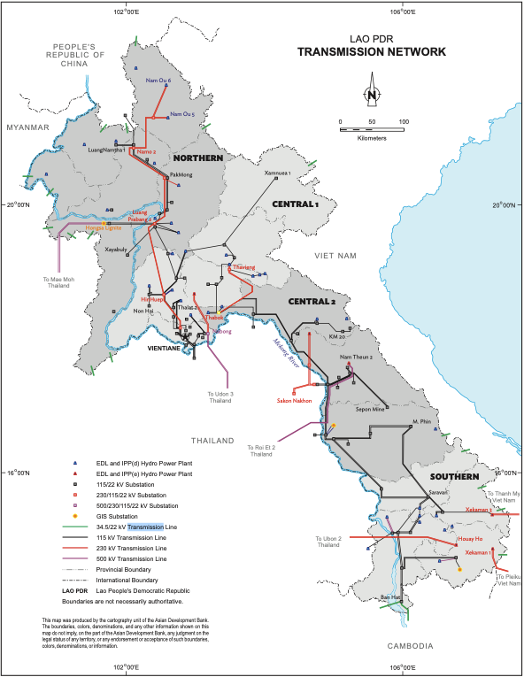

Lao PDR entrusts operation of the transmission network to state-owned utility Électricité du Laos (EDL). Unlike its neighbors, Lao PDR does not have a fully integrated national grid but rather four regional grids often referred to as the northern, central 1, central 2, and southern grids.26Asian Development Bank (ADB), Lao People’s Democratic Republic: Energy Sector Assessment, Strategy, and Road Map. These regional grids have historically operated as discrete systems, but grid expansion and development undertaken during over the last decade has resulted in a now moderately interconnected grid.27Asian Development Bank (ADB), Lao People’s Democratic Republic: Energy Sector Assessment, Strategy, and Road Map. Most of the domestic transmission lines are 115 kV and 230 kV lines. Approximately 14% of the 42 operational transmission lines in the Mekong Infrastructure Tracker dataset are extra-high voltage lines of 230 or 500 kV; most are cross-border lines that support power trade between Laos and Thailand. Many of these lines are separate from the national grid and connect independently-owned export-focused projects directly into Thailand’s national grid.28Asian Development Bank (ADB), Lao People’s Democratic Republic: Energy Sector Assessment, Strategy, and Road Map. There are also two 230 kV lines linking directly to Viet Nam.29Asian Development Bank (ADB), Lao People’s Democratic Republic: Energy Sector Assessment, Strategy, and Road Map. The remaining 29 operational lines are 115kV lines primarily used for domestic transmission, although some cross into Thailand as well.30Asian Development Bank (ADB), Lao People’s Democratic Republic: Energy Sector Assessment, Strategy, and Road Map; “Mekong Infrastructure Tracker • Stimson Center.” Stimson Center, 13 July 2021, www.stimson.org/project/mekong-infrastructure/.

In general, investments in Lao PDR have disproportionately supported power generation: only 1% of the total value of power projects in the pipeline is dedicated towards transmission and distribution projects.31Infrastructure and Cities for Economic Development (ICED). While Laos aims to develop generation capacity through foreign investment in pursuit of its “Battery of Southeast Asia” development strategy, it does so often without securing power purchase agreements with its neighbors. This has resulted in a power surplus.

One major challenge for Lao PDR’s power sector is the financial sustainability of EDL, which depends on a combination of earnings from electricity sales as well as income from some independent power producers.32Asian Development Bank (ADB), Lao People’s Democratic Republic: Energy Sector Assessment, Strategy, and Road Map. These revenue streams have not met expenditures. There are many reasons for this, but chief challenges include tariffs which do not reflect actual cost to the grid system; take-or-pay clauses which commit EDL to purchasing electricity regardless of whether it is needed; and excess capacity with no export market. The continued construction of power plants has seen a substantial domestic generation surplus, with no contingency option to sell excess capacity to export markets.33Asian Development Bank (ADB), Lao People’s Democratic Republic: Energy Sector Assessment, Strategy, and Road Map.

Significant disparities exist between demand and supply inside Lao PDR. Installed capacity in the north and central region surpasses local demand, while southern Lao PDR faces shortages. The lack of a national grid has led to a situation where Lao PDR exports significant amounts of electricity to Thailand from the north but must purchase electricity back at higher costs in the southern grid.34Ricardo Energy & Environment, “Greater Mekong Subregion Power Market Development.” The amount of electricity purchased back is not insignificant. From 2009–2016, imports accounted for around 20% of Lao PDR’ domestic energy consumption.35Asian Development Bank (ADB), “Lao People’s Democratic Republic: Energy Sector Assessment, Strategy, and Road Map. This has caused increasing financial strain on EDL, as Lao PDR pays 11 c/kWh for imported electricity but sells electricity to Thailand at only 5 c/kWh.36Asia News Network, “Laos’ excess power sparks export drive,” The Phnom Penh Post, September 23, 2020 accessed at https://www.phnompenhpost.com/business/laos-excess-power-sparks-export-drive.

In 2016, EDL was unable to meet its debt obligations.37Asian Development Bank (ADB), Lao People’s Democratic Republic: Energy Sector Assessment, Strategy, and Road Map. Rising liabilities has made it difficult for EDL to obtain further financing.38Asian Development Bank (ADB), Lao People’s Democratic Republic: Energy Sector Assessment, Strategy, and Road Map. In 2020, China Southern Grid obtained 90% equity in EDL’s new transmission company EDL-T. EDL-T has signed a 25-year concession agreement that allows it to build and operate critical parts of the Lao grid. The company is reportedly investing $2 billion in the Lao power grid. The Lao Ministry of Energy and Mines has reported that EDL-T will only be taking control of high-voltage powerlines, while EDL, the Lao utility, will control local powerlines that are less than or equal to 230 kV.39Strangio, Sebastian. “Laos Grants 25-YEAR Power GRID Concession to Chinese-Majority Firm.” The Diplomat, The Diplomat, 17 Mar. 2021, thediplomat.com/2021/03/laos-grants-25-year-power-grid-concession-to-chinese-majority-firm/.

The hope is that China Southern Grid’s experience managing China’s grid expansion and access to financial resources will help improve development and management of the national grid in Lao PDR.40Xinhua, “Chinese, Lao firms sign shareholders’ pact for joint venture”, Xinhua, retrieved 23 October 2020 at http://www.xinhuanet.com/english/2020-09/02/c_139338047.htm Grid operations will officially still be overseen by the government of Lao PDR, although outside analysts and media have questioned how the new arrangements will impact income flows to the government of Lao PDR and national energy security.

Prominent Project Snapshot: Xayaburi Dam

| Project Name | Xayaburi Dam |

| Subtype | Hydropower |

| Current Status | Operational |

| Capacity (MW) | 1285 |

| Year of Completion | 2019 |

| Country of Sponsor/Developer | Thailand; Lao PDR |

| Sponsor/Developer Company | Sikarnxangmatalim Company 30%, Natee Synergy 25%, EDL 20%, Electricity Generating Public 12.5%, Bangkok Expressway Public 7.5% , PT Construction 5% |

| Country of Lender/Financier | Thailand |

| Lender/Financier | Kasikorn Bank (Thailand); Bangkok Bank (Thailand); Krungthai Bank Pcl (Thailand); Siam Commercial Bank Pcl (Thailand) |

| Country | Lao PDR |

| Province/State | Xaingabouli |

| District | Xayaburi |

| Tributary | Mekong-Lancang Mainstream |

| Latitude | 19.25401 |

| Longitude | 101.8137 |

The Xayaburi Dam is a 1,285 MW hydropower plant which completed construction in 2018 and began commercial operation in 2019.41Infrastructure and Cities for Economic Development (ICED), “Infrastructure scoping study summary: Laos.”42Xayaburi Hydroelectric Power Project, “Xayaburi Hydroelectric Power Project Fast Facts”, Xayaburi Hydroelectric Power Project, retrieved 4 August 2020. http://www.xayaburi.com/Fast_Fact_eng.aspx Xayaburi was the first dam developed on the mainstream of the Mekong River in Lao PDR. The project receives financing from six Thai commercial banks: Siam Commercial Bank, Kasikorn Bank, Bangkok Bank, Krung Thai Bank, TISCO, and the Export-Import Bank of Thailand (EXIM).43International Rivers, “Xayaburi Dam”, International Rivers, retrieved 4 August 2020. https://www.internationalrivers.org/campaigns/xayaburi-dam EGAT will purchase 95% of the electricity and has committed to a 31-year power purchase agreement.44Hydro Review, “Laos’ 1,285-MW Xayaburi hydropower project receives loan from Thai construction firm”, Hydro Review, retrieved 4 August 2020. https://www.hydroreview.com/2016/05/20/laos-1-285-mw-xayaburi-hydropower-project-receives-loan-from-thai-construction-firm/#gref; International Rivers, “Xayaburi Dam”, International Rivers, retrieved 4 August 2020, https://www.internationalrivers.org/campaigns/xayaburi-dam As the first dam developed on the mainstream of the Mekong River, Xayaburi was the first project to go through the Mekong River Commission’s Procedures for Notification, Prior Consultation and Agreement process. Several controversies surround this run-of-river dam, and the PNPCA process raised significant concerns around the fish passage structure and sediment flushing mechanisms. Any dam on the mainstream of the Mekong will need to support the passage of hundreds of species of migratory fish of varying lengths and masses. No fish ladder in the world has been proven successful on such a scale. The PNPCA process did motivate the developer to spend an additional $400 million on sediment flushing and fish passage technologies, including novel methods. The results have not yet been analysed.45Brian Eyler and Courtney Weatherby, “Letters from the Mekong Series – Mekong Power Shift: Emerging Trends in the GMS Power Sector”, The Stimson Center, retrieved on 23 October 2020

Prominent Project Snapshot: Xe Pian-Xe Namnoy Hydropower Project

| Project Name | Xe Pian-Xe Namnoy Hydropower Project |

| Subtype | Hydropower |

| Current Status | Operational |

| Capacity (MW) | 410 |

| Year of Completion | 2020 |

| Country of Sponsor/Developer | South Korea; Thailand; Lao PDR |

| Sponsor/Developer Company | SK Engineering and Construction 26%, Korea Western Power 25%, Ratchaburi 25%, Lao Holding State Enterprise 24% |

| Country of Lender/Financier | South Korea; Thailand |

| Lender/Financier | Korean Economic Development Cooperation Fund (South Korea); Krungthai Bank (Thailand); Thanachart Bank (Thailand); Export-Import Bank of Thailand (Thailand) |

| Country | Lao PDR |

| Province/State | Champasak |

| District | Paksong |

| Tributary | Sekong, Tributary River System |

| Latitude | 14.94638 |

| Longitude | 106.6274 |

Located in southern province of Champasak, Xe Pian-Xe Namnoy Hydropower Project is a 410MW hydropower plant completed in 2020. Construction of Xe Pian-Xe Namnoy began in February 2013. The project is comprised of three dams (Houay Makchan Dam, Xe Pian Dam and Xe-Namnoy Dam) as well as three auxiliary dams. Xe Pian-Xe Namnoy Hydropower Project was estimated to generate approximately 1,860GWh annually upon completion; however, workers found damage to one of three auxiliary dams on July 22, 2018, at 90% project completion. A saddle dam collapsed on July 23, 2018, releasing an estimated 175 billion cubic feet of water from the Mekong. The dam collapse was catastrophic: six villages were destroyed, over 7,000 people faced long-term homelessness and displacement, and at least 40 lives were lost.46Power Technology, “Xe Pian Xe Namnoy Hydroelectric Power Project”, retrieved on 30 September 2021. https://www.power-technology.com/projects/xe-pian-xe-namnoy-power-project/ 47Ian G. Baird and Brian Eyler, “The Political Ecology of Catastrophic Disasters versus Slow Violence: Thinking about the Impacts of the Xe Pian Xe Namnoy Hydropower Dam in Southern Laos”, The Stimson Center, retrieved on 30 September 2021. The effects of this catastrophic failure reverberated further downstream as communities in northeast Cambodia also faced rapid water level increases and seriously damaged cropland and displaced an additional 5,000 people.48Ian Baird, “Catastrophic and Slow Violence: Thinking about the Impacts of the Xe Pian Xe Namnoy Dam in Southern Laos,” Journal of Peasant Studies, August, 2021, accessed on September 30, 2021 at https://www.tandfonline.com/doi/abs/10.1080/03066150.2020.1824181 The failure of the Xe-Pian Xe-Namnoy Hydropower Project brought local and international attention and criticism to Lao’s plans to become the battery of Southeast Asia in the face of increasing environmental and social risks. In the end, the collapse incurred significant costs to repair the dam, and compensation and rehabilitation for affected communities. Village reconstruction and monetary compensation to those affected has totaled approximately $91.7 million USD, and rebuilding efforts continue into 2021.49Xinhua, “Lao gov’t speeds up recovery efforts in flood-hit southern province”, retrieved on 30 September 2021. http://www.xinhuanet.com/english/asiapacific/2021-06/10/c_1310000561.htm

Xe Pian-Xe Namnoy Hydropower Project received financing from three South Korean sources: Korean Economic Development Cooperation Fund (KEDCF), SK Engineering & Construction (SK E&C), and Korea Western Power Co. (KOWEPO). This project marked the first major power investment and first build-operate-transfer (BOT) project in Laos by SK E&C and KOWEPO. Xe Pian-Xe Namnoy Hydropower Project also received funding from three Thai sources: Krungthai Bank, Thanachart Bank, and Export-Import Bank of Thailand. 370 of the 410MW produced (90%) at Xe-Pian Xe-Namnoy are routed to EGAT through a 27-year power purchase agreement, and the remaining 40MW are kept for domestic consumption.50Power Technology, “Xe Pian Xe Namnoy Hydroelectric Power Project”, retrieved on 30 September 2021. https://www.power-technology.com/projects/xe-pian-xe-namnoy-power-project/

Linear Infrastructure Overview

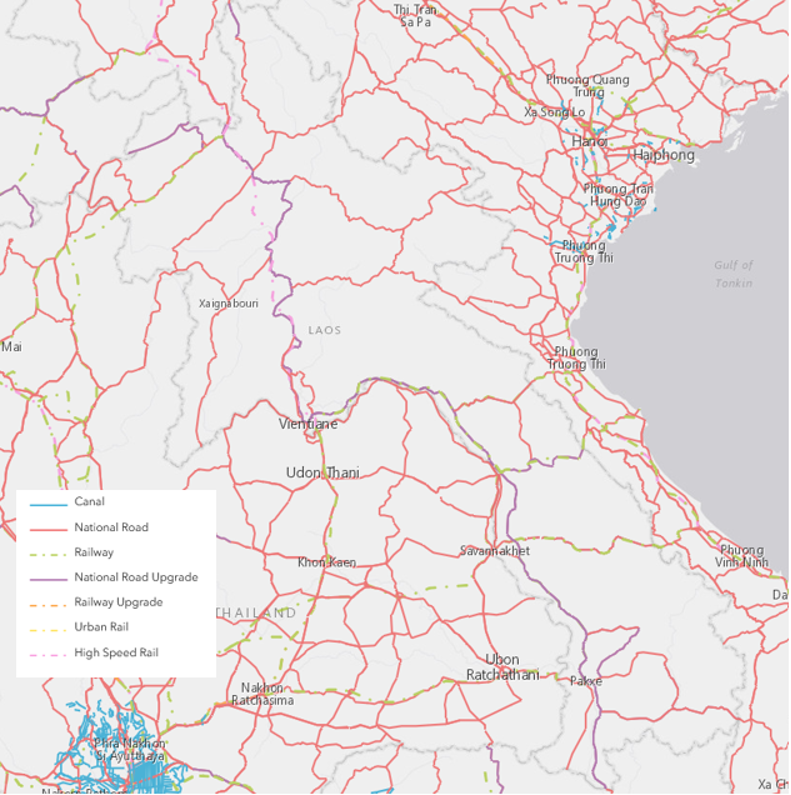

Lao PDR is a landlocked country, but its central location between China, Thailand, Myanmar, Cambodia, and Vietnam means that it plays an important role in regional transit and offers opportunities for it to be developed as a transportation hub.51Asian Development Bank (ADB), Lao PDR: Accelerating Structural Transformation for Inclusive Growth, Country Diagnostic Study. Its World Bank Logistics Performance Index (LPI) score as of 2018 is 2.70, placing it at 82 out of 160 countries globally; this is a significant improvement from 2007 when the country had a score of 2.25 and was ranked 146th. These changes are further reflected in the Greater Mekong Subregion (GMS) economic corridor strategies which prioritize upgrading, rehabilitating, and building new roads to address bottlenecks in Lao PDR and Myanmar.52Asian Development Bank (ADB), “GMS Transpor Sector Strategy 2030”, Greater Mekong Subregion, retrieved on 3 August 2020. https://www.greatermekong.org/sites/default/files/Transport%20Sector%20Strategy%202030.pdf The national government seeks to transform Lao PDR from a land-locked to a land-linked country through providing efficient and reliable transportation infrastructure to facilitate cross border trade and transit.53Department of Planning and Cooperation, Ministry of Public Works and Transport, Lao PDR, “Laos Trade Facilitation: Current on Cross Border Transport Connectivity Infrastructure”, United Nations Economic and Social Commission for Asia and the Pacific (UNESCAP), retrieved on 3 August 2020. https://www.unescap.org/sites/default/files/Session%205_Lao%20PDR.pdf

Road Transport

Road serves the vast majority of passenger and freight transport in the country, and as of 2011 accounted for 98% of passenger travel and 86% of freight moved in the country.54OECD, “OECD Investment Policy Reviews: Lao PDR”, OECD iLibrary, retrieved on 31 July 2020. https://www.oecd-ilibrary.org/finance-and-investment/oecd-investment-policy-reviews-lao-pdr-2017_9789264276055-en The Government of Lao PDR recorded a national road network of roughly 51,500 kilometres in 2014, a 30% increase from 2010.55OECD, “OECD Investment Policy Reviews: Lao PDR.” The Mekong Infrastructure Tracker has project-level details across all statuses on 6,410 km of national roads, 4,882 km of national road upgrades, 1,367 km of railway, and 446 km of high-speed rail.

Notwithstanding the importance of roads to economic activity, only about 16% of the existing road network is paved, and over 87% of the Asian Highway route network within Lao PDR – which provides the backbone linkages inside Lao PDR and to neighboring countries – are rated at or below the minimum desirable standard.56OECD, “OECD Investment Policy Reviews: Lao PDR.” Moreover, about 40% of the villages lack access to all-weather roads.57OECD, “OECD Investment Policy Reviews: Lao PDR.” Most public investment has been directed toward extending the network rather than upgrading or maintaining the existing roads.58OECD, “OECD Investment Policy Reviews: Lao PDR.”

Railway Transport

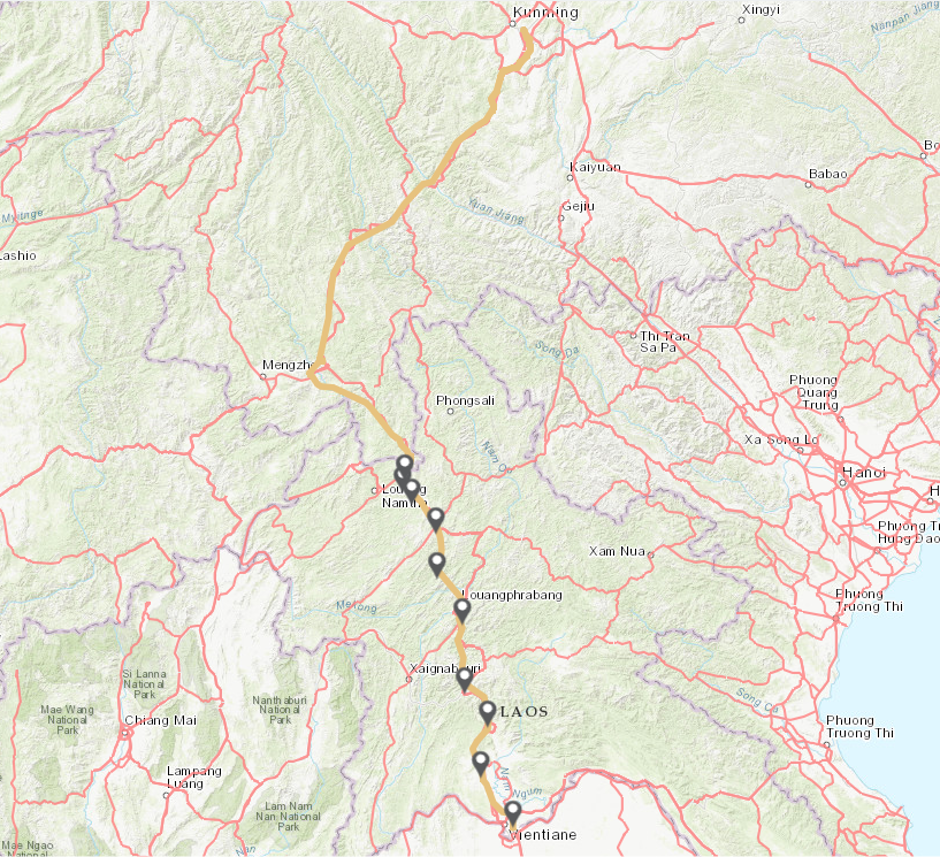

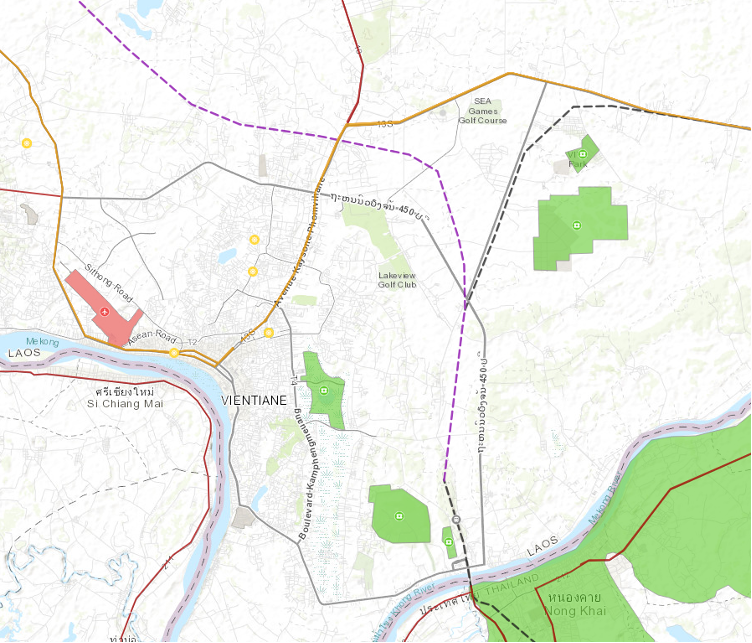

Operational railway infrastructure is almost nonexistent in Lao PDR.59OECD, “OECD Investment Policy Reviews: Lao PDR.” The only currently operational rail infrastructure currently is a 3.5 km extension running across the Friendship Bridge from Nongkhai in Thailand that connects east of Vientiane and is primarily used for tourism and freight purposes.60Open Development Laos, “Infrastructure”, Open Development Mekong, retrieved on 3 August 2020. https://laos.opendevelopmentmekong.net/topics/infrastructure#ref-444-11 However, a new high speed rail link extending 414km to connect China to Vientiane through Laung Namtha, Oudomxay, and Luang Prabang provinces will be completed on December 2nd, 2021, which is also Lao National Day.[mfnChen, Wanjing (Kelly), and Jessica DiCarlo. “Laos–China Railway.” The People’s Map of Global China, The People’s Map of Global China, 2 Sept. 2021, thepeoplesmap.net/project/laos-china-railway/.[/mfn] There are a few other rail links currently under consideration: one would connect Thailand and Vietnam across Savannakhet province in southern Lao PDR; a second would run from the Savanakkhet line to Pakse in southern Lao PDR; a third would run south along the Lao-Thai border from Vientiane to Thakhek; and a fourth would connect to another line from Thakhek to Vung Ang in Vietnam.

Industrial Zones

Industry continues to play a prominent role in the Lao economy, rising to 30.9% of GDP as of 2019.61World Bank, “Industry (including construction), value added (% of GDP) – Lao PDR,” 2017 data, accessed October 26, 2020, at https://data.worldbank.org/indicator/NV.IND.TOTL.ZS?locations=LA. While industry’s 14.1% share of the labor force is relatively low compared to services (42.2%) and agriculture (31.3%),62International Labour Organization, “Country Profiles – Lao People’s Democratic Republic,” 2017 data, accessed October 26, 2020, at https://ilostat.ilo.org/data/country-profiles/. the Lao PDR’s position as a nexus between China and many other fast-growing Southeast Asian nations has incentivized the development of many connectivity-boosting industrial initiatives. The Mekong Infrastructure Tracker dataset provides details on 27 industrial projects including 11 airports, 2 railway stations, and 14 special economic zones (SEZs).

Air Transport

There are eleven airports in Lao PDR, four of which—Luang Prabang, Vientiane, Pakse, and Savannakhet—have international service. These four international airports handle 2% of the country’s total transport volume and approximately 1.16 million scheduled inbound international travelers.63Asian Development Bank (ADB), “Lao PDR: Accelerating Structural Transformation for Inclusive Growth, Country Diagnostic Study.” Upgrades and construction of new airports are primarily driven by goals of increasing tourism. However, Lao PDR lags behind many other countries in ASEAN in terms of direct, medium, and long-haul flights and depends on the Bangkok airport and other regional hubs for connections.64Asian Development Bank (ADB), “Lao PDR: Accelerating Structural Transformation for Inclusive Growth, Country Diagnostic Study.”

The China-Lao PDR railway project has been under consideration for over a decade. Originally planned as a component of the Pan-Asian railway concept, this central railway connection is the only leg moving forward and is supported by China’s Belt and Road Initiative. The Lao PDR-China Railway is envisioned as one leg of a multi-country railway which will ultimately connect Kunming, China to capital cities in Lao PDR, Thailand, Malaysia, and Singapore. This leg of the project is supported by Lao PDR and China and will construct 414km of railway running from China’s provincial capital of Kunming to Vientiane.65Infrastructure and Cities for Economic Development (ICED), “Infrastructure scoping study summary: Laos.” It would also serve as the central route of the railway network which ultimately aims to connect Kunming to Bangkok, Kuala Lumpur, and Singapore.66Open Development Laos, “Infrastructure”, Open Development Mekong, retrieved on 3 August 2020. https://laos.opendevelopmentmekong.net/topics/infrastructure#ref-444-11 Construction began in December 2016 and will begin official operation on December 2, 2021.67Infrastructure and Cities for Economic Development (ICED), “Infrastructure scoping study summary: Laos.”

This project is a joint investment by Lao PDR and China, and the Chinese government has committed to covering 70% of the $6 billion required to fund the project. The Lao government is responsible for the remaining 30% and has met the obligations through $250 million of public spending and taking out a $465 million loan from China’s Export-Import Bank.68Scott Morris, “The Kunming – Vientiane Railway: The Economic, Procurement, Labor, and Safeguards Dimsneions of a Chinese Belt and Road Project,” Center for Global Development, 2019, page 6, at https://www.cgdev.org/sites/default/files/kunming-vientiane-railway-economic-procurement-labor-and-safeguards-dimensions-chinese.pdf. The Railway’s main contractors are the China Railway Group Limited (CREC), Power Construction Corporation of China, and China Railway Construction Corporation Limited (CRCC). Project developers include the Laos-China Railway Company Limited, Lao National Railway State Enterprise, Boten-Vientiane Railway Company Limited, China Investment Corporation, and Yunnan Investment Group.69Chen, Wanjing (Kelly), and Jessica DiCarlo. “Laos–China Railway.” The People’s Map of Global China, The People’s Map of Global China, 2 Sept. 2021, thepeoplesmap.net/project/laos-china-railway/.

Outside analysts including the International Monetary Fund have raised concerns about the railway’s impact on Lao PDR’s debt holdings. The railway’s profitability and direct benefits to Lao PDR have also come under question by non-government organizations and regional media. Environmental impact assessments for the railway projects and its stations have not been publicly released. For more information see this Storymap on the China-Lao PDR Railway.

Special Economic Zones

To foster industrial development and regional supply chain support, Lao PDR has approved fourteen Special Economic Zones with a total area of 463 square kilometers. These SEZs provide favorable investment conditions to the companies which lease land plots for industrial development and companies which invest in operations inside of those zones. Five of the licensed SEZs support industrialization around Vientiane, while the others are located at strategic border areas around the country. Five of the zones are leased to Chinese companies for ownership and operation, and these zones account for 244 square kilometers of Lao territory, more than half the total area incorporated as SEZs. Other countries with full or partial ownership of SEZ leases are Vietnam, Thailand, and Korea.

Prominent Project Snapshot: Golden Triangle Special Economic Zone

| Project Development Cycle Stage | Project Completion |

| Year of Completion | 2007 (established as a economic and tourism zone); 2010 (established as a Special Economic Zone) |

| Total Investment (million USD) | $900 million |

| Area (km2) | 100 |

| Sponsor/Developer: | Government of Lao PDR, Dok Ngiew Kham (AKA Kings Roman Investment Group; Hong Kong, China) |

| Country list for Sponsor/Developer | China, Lao PDR |

| Country | Lao PDR |

| State or Province | Bokeo |

| District | Tonpheung |

| Main River Basin | Mekong River |

| Specialty | Agriculture, livestock, manufacturing |

| Type of Contract | Concession |

| Length of Lease | 99 years |

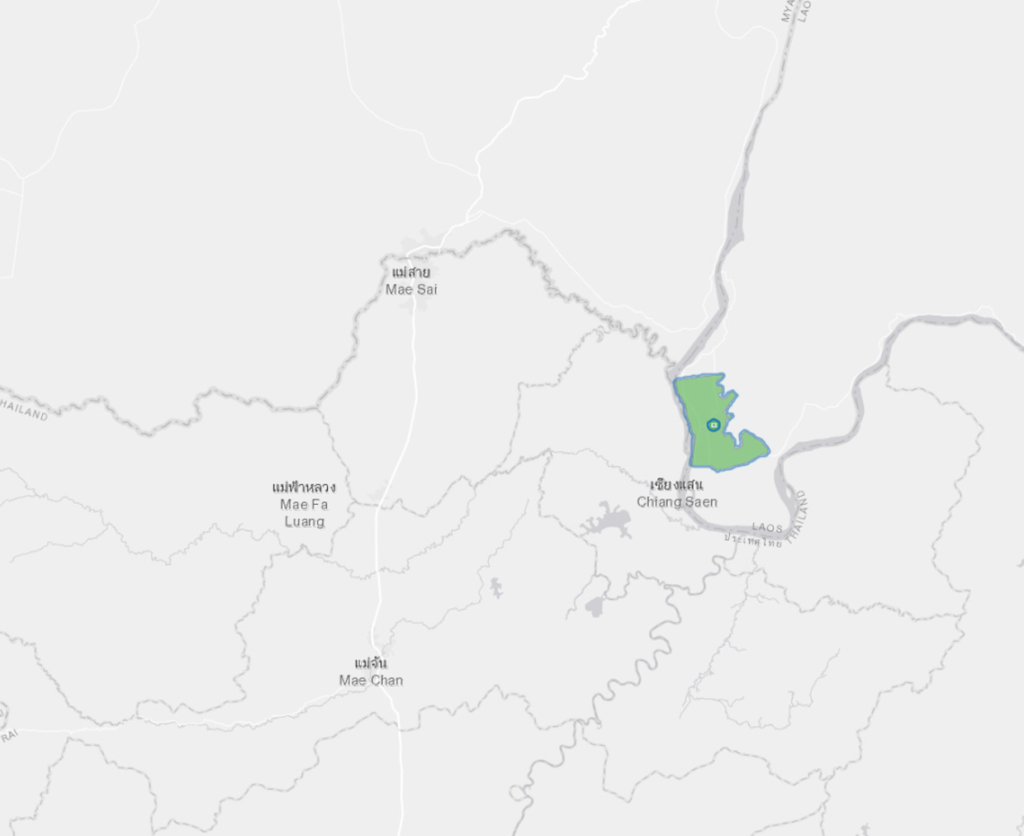

The Golden Triangle Special Economic Zone is an investment from Hong Kong-based Kings Roman Group (Dok Ngiew Kham Group). The GTSEZ was originally established in 2007 as a smaller economic and tourism zone, but after the national government passed laws on special economic zones in 2010 the project was expanded.70Chiang Mai University, “Golden Triangle Special Economic Zone and Changes to The Tonphueng Border Landscape,” 2013, accessed November 2, 2020, at http://archive.lib.cmu.ac.th/full/T/2013/sudev40113ss_ch3.pdf. As of 2020, the project developers from Kings Roman indicate that approximately $900 million has been spent on development of the SEZ.71Golden Triangle Special Economic Zone, Lao PDR, “Blueprint of the GTSEZ,” accessed November 2, 2020, accessed at http://gtsez.la/ztgh. Although the SEZ has created more jobs than initially projected, 96% of these are for foreign laborers.

The GTSEZ’s centerpiece is the Kings Roman Casino, which attracts significant numbers of Chinese gamblers and tourists. The complex has come under significant international scrutiny: a 2015 report by the Environmental Investigation Agency indicated that the complex was involved in illegal wildlife trade.72Environmental Investigation Agency, “Sin City: Illegal wildlife trade in Laos’ Special Economic Zone,” March 19, 2015, accessed November 2, 2020, at https://eia-international.org/report/sin-city-illegal-wildlife-trade-in-laos-special-economic-zone. In 2018, the United States added Zhao Wei—the CEO of King Romans Company—and his company to the Specially Designated Nationals list of transnational criminal organizations for the SEZ’s role in regional criminal activity including drug, human, and wildlife trafficking.73U.S. Department of the Treasury, “Treasury sanctions the Zhao Wei Transnational Criminal Organization,” January 30, 2018, accessed October 26, 2020, at https://home.treasury.gov/news/press-releases/sm0272.

Notes

- 1Asian Development Bank (ADB), Lao People’s Democratic Republic: Energy Sector Assessment, Strategy, and Road Map.